Disbursements

When we refer to disbursements, we encompass all funds issued under Export Credit payments (pre-finance requests), Buyer Credit payments made directly to suppliers and the release of Stock Facility and Term Loan funds. Together, these represent the total amount of capital deployed to our partners across the trading cycle and provide a central measure of our financial reach and developmental impact.

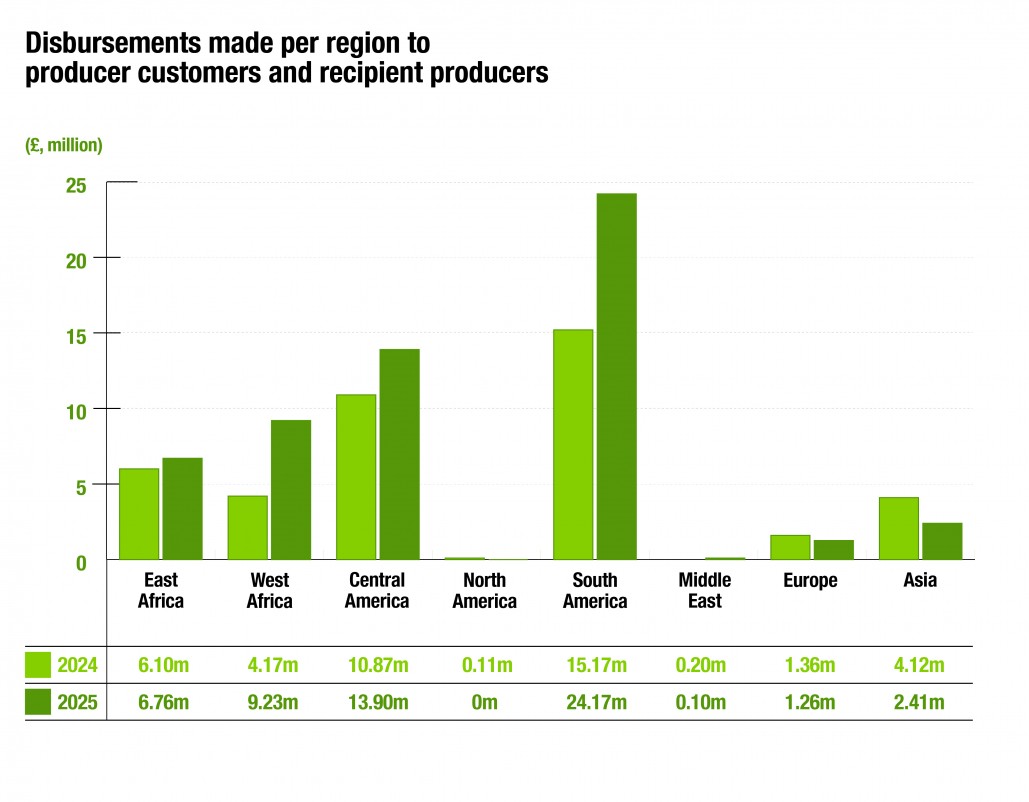

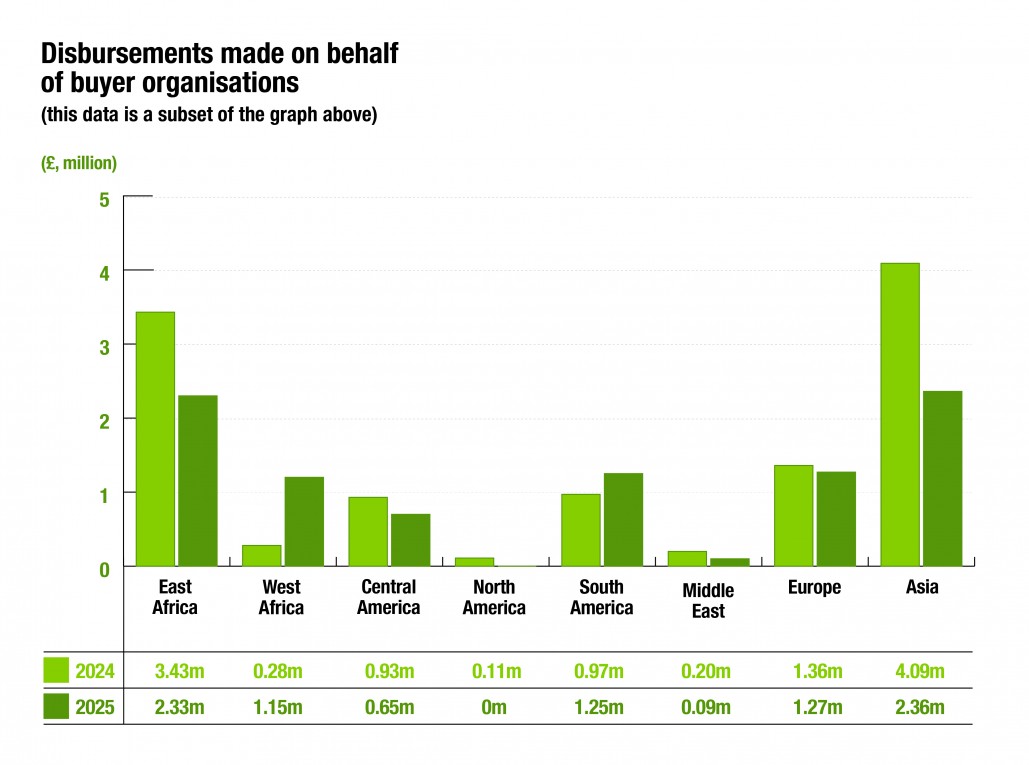

Total disbursements reached £57.95m, a 37% increase from £42.1m in 2024. Latin America contributed £12m of this increase, while East Africa grew by £660k. This marks a significant step forward in lending activity, reflecting the strengthening of our operational capacity and the growing trust of our customers.

The rise also signals a shift in the market environment: after several years of suppressed liquidity demand in the cocoa and coffee sectors, producer organisations are again seeking timely finance to support more ambitious trade volumes and respond to fluctuating commodity prices.

Click here to read the full Social Accounts document.

Back to menu