Lending per region

Regional performance remained strong during this period, reflecting a balance between direct producer finance with strategic buyer relationships.

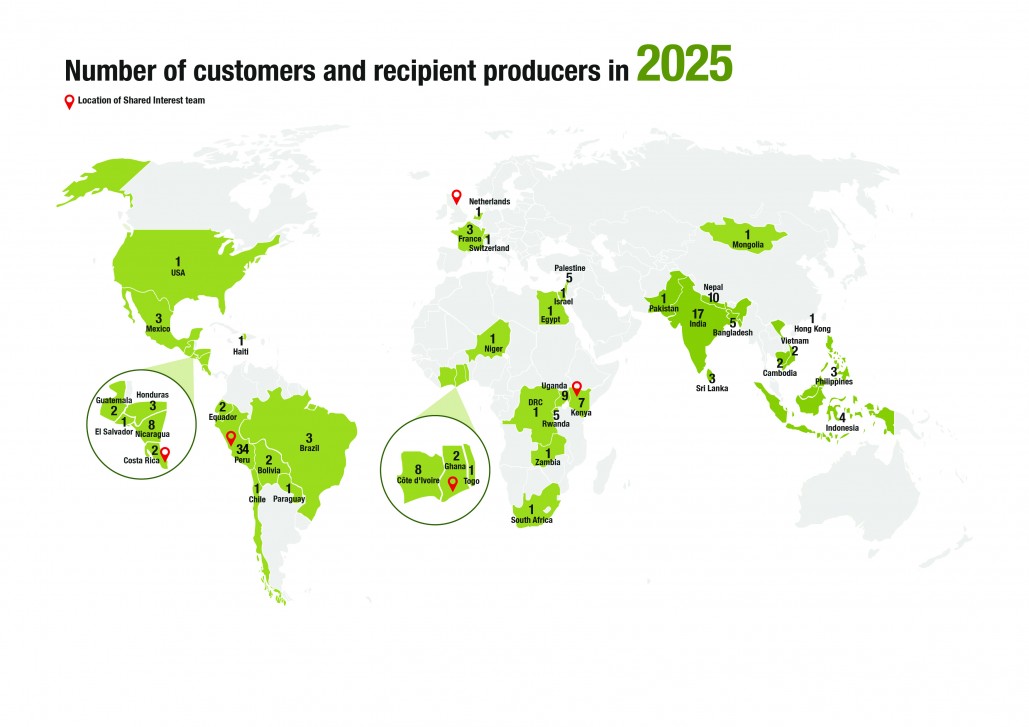

Latin America remained the strongest regional, contributing to £12m of the total £38m in disbursements of (£9m in South America and £3m in Central America). The region benefited from healthy post-pandemic recovery, improved liquidity among co-operatives and a strong pipeline of repeat borrowers who demonstrated enhanced creditworthiness. In several cases, co-operatives that had previously scaled back due to market uncertainty resumed normal trading activity, supported by our flexible refinancing approach.

East Africa continued its steady expansion, with disbursements increasing by £660k to reach £6.76m. While modest in absolute terms, this growth is strategically significant, signalling greater resilience among coffee co-operatives operating in a context of climate variability, foreign exchange constraints and political risk. The rise in disbursements reflects the region’s ability to remain competitive in a high-price environment and underscores the effectiveness of our regional relationship management model.

Indirect Lending and Buyers

In regions where direct lending is constrained by political, economic or regulatory barriers, our buyer relationships have proven vital in maintaining access to finance for disadvantaged producer communities. This adaptive mechanism has become a defining feature of our delivery model.

In the Indian subcontinent, where restrictions continue to limit direct lending to organisations, our buyer credit facilities enabled 652 payments to 33 businesses, totalling £2m.

Beyond Asia, additional buyer-facilitated payments reached fair trade organisations across Sub-Saharan Africa, Europe, Latin America and North America, reinforcing our capacity to deliver value through an integrated global network. This diversification not only broadens our impact but also mitigates concentration risk by balancing exposure across markets and lending channels.

SERVV is an example of a buyer in North America supporting handcraft producers in countries such as Vietnam and South Africa. We have provided finance to SERVV since 1998.

Kate Doye Betts, former CEO of SERVV, said:

"The impact of [the] advance payment empowers producers both economically and socially. And with the sale of beautiful handicrafts and foods, SERRV is able to assist producers through grants, training, disaster relief, tech, design and financial aid.”

Click here to read the full Social Accounts document.

Back to menu