Due diligence and management of our risk portfolio

Risk management

We remain committed to providing financial support to enterprises in vulnerable regions, particularly those affected by climate change and fluctuations in commodity prices. Our core strategy employs a robust, hybrid due diligence framework to evaluate the operational viability, financial stability and long-term sustainability of the 165 businesses we support.

Our framework is guided by comprehensive credit policies and Board-approved prudential limits with our Credit Committee forming the cornerstone of lending decisions. These limits manage sector, commodity, and country exposure, preventing overexposure to any single risk area by capping the proportion of Share Capital that may be allocated to each category.

They are dynamic, adjusting in real-time based on market assessments, borrower performance, and country-specific risk, which is often informed by independent credit insurers. For higher-risk regions, such as Nicaragua, we apply enhanced mitigation and close monitoring.

Due diligence

The due diligence process combines both on-site and virtual assessments. On-site visits provide essential qualitative and quantitative data by enabling a comprehensive assessment of a business's assets, management practices and local market conditions.

Virtual due diligence (using detailed reports and recorded meetings) is employed when logistical constraints such as political instability or remoteness make physical travel impractical. These are subsequently supplemented with an on-site visit or verification from other social lenders’ insights when possible. The reports are required to meet stringent standards of accuracy and completeness to ensure that the integrity of our assessment is maintained.

Country risk assessment

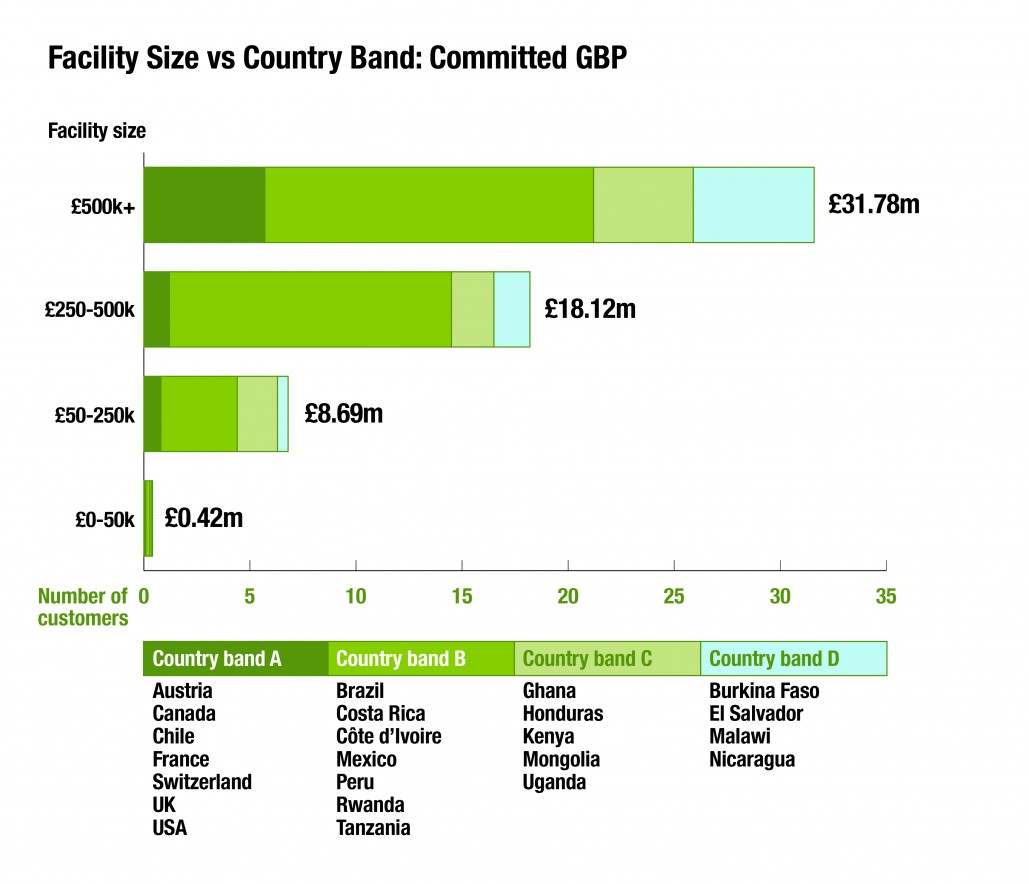

To manage country-specific risks, we use a detailed risk assessment framework developed by the independent credit insurer, Coface. This framework classifies countries into four distinct risk bands - A (lowest risk) to D (highest risk) - based on a mix of economic, political and financial stability indicators. Each risk band is accompanied by prudential lending limits designed to restrict exposure in higher-risk regions while providing greater flexibility in more stable markets.

Our portfolio remains concentrated in the lower-risk A and B categories, with carefully controlled exposure to C and D markets. This prudent approach ensures a balanced risk distribution while continuing to support businesses in developing countries, as illustrated in the graph adjacent.

Although Nicaragua remains a Category D country, the strength of viable lending opportunities in the market prompted us to increase our exposure. This decision reflects robust demand for finance from well-performing co-operatives and the potential for sustainable returns, even within a higher-risk environment. The adjustment was made with close attention to portfolio balance, ensuring that increased exposure is matched by enhanced monitoring and prudent facility structuring to mitigate country and counterparty risks.

Click here to read the full Social Accounts document.

Back to menu